In economics, a bubble refers to a rapid rise in asset prices, to the point that they become disconnected from the fundamental value of the underlying asset. A change in investor behaviour is the most common cause of a bubble. When many investors rush to invest in a new technology or take advantage of low interest rates, for example, the increased demand for the asset can raise the price far above its real worth.

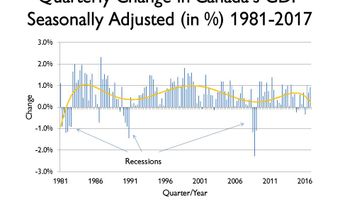

Bubbles are generally followed by collapses in prices. When large enough, bubbles tend to give way to economic slowdowns, recessions or even depressions (long periods of financial decline).

The Japanese stock market bubble of the late 1980s is one contemporary example of a bubble. Others include the “dot-com,” stock market and housing bubbles in the United States during the late 1990s and the mid-2000s. In Canada, the Vancouver housing market displayed many of the characteristics of a bubble in the late 2010s. As of September 2020, benchmark selling prices exceeded $1 million. This price was very high relative to average household incomes and rents in Vancouver.

In recent years, the Bank of Canada and the US Federal Reserve have built asset price increases into their financial models and policy actions. This is an effort to make asset holders feel richer and spur them to spend more, thus creating broader overall wealth. This process led to rises in stock, bond and housing prices in both countries to near record levels in the late 2010s.

The COVID-19 pandemic led to a stock market collapse in March 2020, but markets quickly rebounded. In some cases, markets beat their previous records mere months later. Thus, while the pandemic led to a global economic downturn, it did not involve the collapse of a bubble. Instead, stock, bond and housing prices have continued to rise.

Whether these increases constitute a bubble is unclear. Experts are generally reluctant to publicly acknowledge bubbles for fear of causing panics. For this reason, bubbles are generally only recognized as such after a crash has occurred.

See also The Great Crash of 1929 in Canada; The Great Depression in Canada; Recession of 2008–09 in Canada.

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom