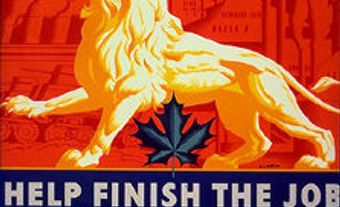

A bond is a tool that businesses, governments and other organizations use to borrow money. More specifically, it is a loan agreement through which the bond issuer (the borrower) agrees to pay the lender a specified amount by a certain date. Bond agreements generally also include interest payments. While the borrower usually pays the lender interest on the loan, bonds sometimes have negative interest, meaning the lender pays interest to hold the bond. Bonds and debt financing are important tools for funding large infrastructure projects and wars. (See Canada Savings Bonds; Victory Loans.)

The Canadian government owed almost $686 billion in outstanding bonds as of 30 June 2020. Canadian domestic non-financial sectors owed $2.3 trillion at that time. According to the Securities Industry and Financial Markets Association, there were nearly US$106 trillion worth of bonds outstanding at the end of 2019 in the global economy.

The general public, media and politicians tend to focus on the stock market as a reflector and driver of economic activity. But experts believe that the larger bond markets (also called debt markets) are far more important.

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom