Value of Real Estate

Real estate is characterized by immobility, by durability (the availability of services or income over a long period) and by uniqueness (no two properties are identical), as well as by a special body of laws and legal institutions. Real estate values tend to fluctuate, increasing during periods of (and in regions experiencing) rapid economic growth and remaining stable or declining during periods of (and in regions experiencing) slow economic growth. The durability of real estate contributes to the price fluctuations. A small change in the rents of an apartment building may have a significant impact on its value if the new rent will be received for many years to come. Values may also fluctuate as a result of the slow adjustment of supply to a change in demand, and they are sometimes magnified through speculation (demand or supply arising from expectations of further price changes).

Improvements to one property generally affect the value of another, and transaction costs are high (including commissions, legal and appraisal fees, financing, surveying and registration costs). For residential properties the commission alone can amount to 3 per cent or more of the selling price. Some jurisdictions have a real estate transfer tax that may add an additional 2 per cent.

Price Bubbles

Real estate prices can rise rapidly when demand exceeds supply, especially if demand is fueled by anticipation of further price increases. Expectation-driven demand can create price bubbles, i.e., prices not sustainable based upon fundamental economic conditions.

Real Estate Agents

It is common for vendors to use a real estate agent to assist with the sale. The property is then generally listed for sale with a real estate company (listing agent) which handles marketing, advertising, open houses, placement of signs, etc. The listing agent often co-operates with other real estate companies, through a multiple listing service (MLS), whereby a member firm may list properties to be sold by other members, as well as sell properties listed by others. The firm finding a purchaser becomes the selling agent. Both listing and selling agents are often agents of the vendor, who pays the commission when the property changes hands, but dual agency (an agent representing both vendor and purchaser) is also common. Normally, no commission is payable if the deal does not close. If more than one company is involved in the transaction, the commission is shared among them, often equally, but unequal splits are also common. The companies in turn share with the sales people involved.

Mortgages

It is common for the actual transfer and registration, as well as all legal documents, to be handled by a lawyer. The term “deal pending” refers to a property in the process of being sold, where there is an accepted offer, in some regions after conditions of the offer have been removed, in others with conditions of the contract yet to be satisfied, e.g., a mortgage to be arranged. The comparatively high value of real estate would put it beyond the reach of most people were it not for mortgages. The security of real estate enables financial institutions to lend a substantial portion of the value of the property, making ownership possible with a limited amount of owner equity (non-mortgaged portion of value). This, however, also makes real estate values dependent on mortgage rates, which then become another source of price fluctuations (see also Interest Rates in Canada). Canada Mortgage and Housing Corporation (CMHC), is a crown corporation and national housing agency active in housing related research and policy (see Housing and Housing Policy). An important function is insuring home mortgages, where the down payment is less than 20 per cent of property value.

Real Estate Ownership

Ownership rights originally extended from the centre of the earth to the sky, but are now generally limited to surface rights only. In Canada, subsurface rights, particularly mineral rights, are usually reserved unto the Crown, even where the real estate is privately owned (see also Crown Land). Air rights are also held by the Crown. In addition, government also retains the right to tax, expropriate, escheat (inherit in the absence of heirs) and regulate (through land-use and zoning laws, building, health and fire codes or rent controls). Property title in many provinces is registered in the local land-titles office, providing proof of ownership. Real estate can be owned individually or collectively, by corporations, co-operatives, partnerships, syndicates, etc. The term completion refers to when the transfer of title is registered at land titles and the money changes hands. The term possession is used for when the purchaser is given access to the property (see Property Law).

Legal Identification

Real estate is formally referred to by its legal description, e.g., in cities, towns and hamlets by lot, block and plan. Condominiums (high-rise, row house or office) are described by unit number and condominium plan. In rural areas, land is normally referred to by sections, townships, ranges and meridians.

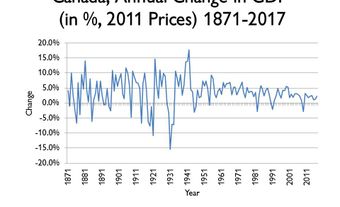

Real Estate and the Canadian Economy

Housing starts are an important economic indicator, and construction expenditures play a major role in the economy. The annual total of housing and housing-related expenditures generally amounts to close to 20 per cent of GDP. In 2016, the total value of all building permits issued exceeded $85 billion. (The total value of all building permits issued conveys approximately the value of additions to the stock of buildings and other improvements, but not the value of land upon which they are being built.)

The total value of all real estate sales processed through the Multiple Listing Service (MLS) systems in Canada during 2016 exceeded $274 billion. There were about 567,000 total transactions by some 121,000 members of the Canadian Real Estate Association (CREA). Valuation of real property for a variety of purposes is performed by appraisers accredited by the national association of professional real estate appraisers, the Appraisal Institute of Canada. Valuation (assessment) for property tax purposes is performed by assessors. Some universities (e.g., the University of British Columbia, Université Laval) offer degree programs in real estate and urban and land economics. There are also several journals devoted to real estate.

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom