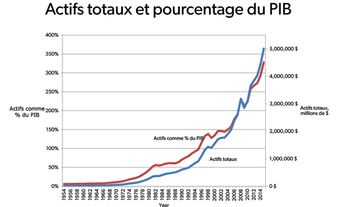

The Bank of Montreal was founded in 1817, making it Canada’s oldest incorporated bank. From its founding to the creation of the Bank of Canada in 1935, the Bank of Montreal served as Canada’s central bank. Today, the various components of the Bank of Montreal are collectively known as BMO Financial Group. BMO is Canada’s fourth largest bank by assets, and the eighth largest in North America. It offers services in three distinct areas — personal and commercial banking, wealth management, and investment banking. BMO is a public company that trades on the Toronto Stock Exchange and the New York Stock Exchange under the symbol BMO. In 2023, BMO registered $31.2 billion in revenue and $4.37 billion in net income and held $1.29 trillion in assets. BMO employs 55,767 people who serve more than 13 million clients globally.

History of the Bank of Montreal (BMO)

Founding and Early History: 1817–67

BMO Financial Group, commonly known for its Bank of Montreal operations, is Canada’s oldest incorporated bank. Founded in Montreal in 1817 by a group of nine of the city’s most prominent figures, its original name was Montreal Bank. The bank was established primarily for business customers, helping them conduct their trades both in the city and beyond. Its purposes were to provide a form of paper money for its customers, a place where they could deposit their savings for safekeeping, a source of loans to borrow money, and a foreign exchange (see Banking in Canada).

As the country grew quickly, so too did the Montreal Bank. Almost immediately, it was the official banker for the Government of Lower Canada (Quebec). In 1818, the bank began operating outside of this region through business associations with other banks located in London, New York and Boston. At the same time, it opened offices in Quebec City and Kingston based on demand for its services by business clients.

In 1822, the bank converted from a private company owned by a few people into a public company owned by 144 shareholders. At this time, it became officially known as the Bank of Montreal. In 1842, it obtained its first Toronto branch (then the town of York) when it took over that city’s Bank of the People. In 1864, the Bank of Montreal became the official banker for the government of the Province of Canada, making it responsible for financing government operations. In 1867, the year of Confederation, the bank expanded to the Maritime provinces for the first time, opening branches in New Brunswick and Nova Scotia.

Post-Confederation

As Canada continued to grow after Confederation, the Bank of Montreal focused its business lending on the rapidly growing lumber, railway and industrial companies. The boom in Canada’s foreign trade at the time benefited the bank greatly. This encouraged it to open its first permanent branch in New York in 1859 and in London, England, in 1870.

This international growth allowed the Bank of Montreal to enter the investment banking industry, when, in 1874, it issued a bond to England for Quebec. This new part of the business began to grow rapidly, fuelled in part by the bank’s role as the main source of financing activity for the Canadian Pacific Railway, being built in the 1880s. The Bank of Montreal was responsible for selling the railway’s bonds, issued by the federal government. Once built, the railway provided the opportunity for the bank to open a branch in Winnipeg in 1877, in Calgary in 1886 and in Vancouver in 1887. By 1890, Bank of Montreal’s investment banking operation began issuing bonds for corporations in addition to governments.

As the banking industry grew in size and importance within Canada, the Bank of Montreal joined with all other banks to create the Canadian Bankers Association in 1891. This organization became the country’s clearing centre for business conducted between banks. In 1892, the bank became the official fiscal agent responsible for selling the federal government’s bonds in London, England, taking over from several English firms. This solidified the Bank of Montreal as the principal banker for Canada, now both within and outside the country.

Early 20th Century and the First World War

By the turn of the century, the Bank of Montreal had 52 branches and 562 employees. This growth required the expansion of a new head office in Montreal. It was completed in 1905 and remained its head office until 1960.

The bank continued to grow by acquiring the Exchange Bank of Yarmouth, Nova Scotia, in 1903, the People’s Bank of Halifax in 1905, and the People’s Bank of New Brunswick in 1906. That same year, the Bank of Montreal rescued the Ontario Bank from financial difficulty when it absorbed its operations. Internationally, the bank opened its first office in Mexico City in 1906.

As financial agent for the government, the Bank of Montreal was called on to play a leading role in financing the war effort during the First World War — for example, remitting payments from the federal government to troops and officers. With the weakened London financial market closed to Canada in 1914 because of the war, the bank led the first federal government bond issue in New York in 1915 to help it raise money for the war effort. Through its extensive branch system across Canada, the bank also participated actively with other banks in issuing Victory Bonds to the Canadian public beginning in 1915.

Interwar Years and the Great Depression

Immediately post-war, in 1918, the Bank of Montreal acquired the Bank of British North America and its 79 branches. This strategic purchase of a prestigious competitor significantly increased the bank’s presence in Western Canada. Around this time, competition for deposits was growing among banks. The Bank of Montreal expanded its operations outside of business services and began adding retail customer deposits as a matter of normal business.

At the same time, the bank’s international presence grew when it opened its first branch in Paris, France, also in 1918. The bank then purchased the Colonial Bank in 1920, which operated primarily in the West Indies and West Africa, a transaction that encouraged it to officially create a foreign department. Within Canada, it purchased the struggling Merchants Bank of Canada in 1921, a move that added more than 400 branches across the country. A merger with the Molson Bank followed in 1924, along with its 125 branches. Each of these acquisitions aided the conversion of the Bank of Montreal to a bank with a strong retail deposit base in addition to its historical business focus.

As was the case for many businesses in Canada, the Great Depression challenged the Bank of Montreal. The number of bank branches shrunk from 669 in 1929, to 567 in 1934, and the Mexican branch was closed in 1931. As the number of banks in the country declined due to a combination of bank failures and mergers, popular discontent led by farmers encouraged the federal government in 1934, on the recommendation of the federal Macmillan Commission, to create a new central bank for the country, the Bank of Canada. After 117 years in the role, the Bank of Montreal was forced to relinquish its position as official banker to Canadian governments. This shift meant the Bank of Montreal lost its largest business customer. Nevertheless, the bank quickly recovered and its assets exceeded $1 billion for the first time in 1939.

Second World War and Late 20th Century

During the Second World War, all activity of the bank was focused on maintaining its business and aiding in the war effort. In March 1942, George Spinney, general manager of the bank, was assigned to head the federal government’s National War Finance Committee. The combination of the depression followed by the war led to a reduction in the number of bank branches, dropping from a high of 672 in 1930 to a low of 468 in 1943.

Post-war, Canadian banks resumed their growth. As a notable change, all banks were at last authorized by the government to lend money to their customers to purchase real estate such as homes and small businesses (see Mortgage). In 1954, the Bank of Montreal became the first chartered bank to do so.

This change in policy marked a significant shift not only for the Bank of Montreal, but for all Canadian banks. As a result, a bank’s portion of consumer assets such as loans and mortgages grew remarkably, and its investment in government bond assets decreased, resulting in a riskier asset profile for the bank. In addition, competition between banks for retail deposit customers increased. To manage this growth in retail business, the Bank of Montreal opened its first data-processing department in 1963. The competition between banks increased further when the federal government removed the maximum interest rate a bank can charge on loans in 1968.

In 1963, American-owned Citibank took over the Mercantile Bank of Canada, raising fears that foreign ownership of Canadian banks was set to increase. In response, the federal government amended the Bank Act in 1967, limiting foreign ownership of banks to 25 per cent of total shares. As the world economy grew and became more interconnected, Canada’s banks saw this rule as a limit to their ability to grow and compete internationally. The Bank of Montreal responded to this regulatory limitation by purchasing Chicago-based bank Harris Bancorp in 1984. This purchase was a bold move for a Canadian bank, based on a strategy to build a significant presence for the Bank of Montreal in the Midwestern American marketplace. The transaction made the Bank of Montreal the first bank in North America to have full operations in both Canada and the United States. Ten years later, in 1994, the Bank of Montreal became the first Canadian bank to list its shares for trading on the New York Stock Exchange.

To add further growth, banks began buying independent stock brokerage firms in Canada (see Stock and Bond Markets). The purchases were meant to expand their presence in investment banking in order to diversify their business outside of traditional banking. In 1987, the Bank of Montreal participated in this strategy by buying a 75 per cent ownership stake in brokerage firm Nesbitt Thomson, Inc. It expanded this area of business when it merged Nesbitt Thomson with the oldest remaining independent brokerage firm Burns Fry in 1994. It renamed the now wholly owned subsidiary BMO Nesbitt Burns. Now called BMO Capital Markets, this arm of the bank contributes approximately 19 per cent to the organization’s total reported earnings (2018).

More significantly, Bank of Montreal and Royal Bank of Canada, the country’s two largest banks, shocked everyone when they announced their intention to merge in 1998 (see Royal-Montreal Bank Merger). Their logic was to create a larger, single Canadian bank that would be better able to compete internationally. However, the federal government prohibited this merger on the grounds that it believed the country would be ill-served by fewer, larger banks. About the same time, Canadian Imperial Bank of Commerce and Toronto-Dominion Bank were also contemplating a merger (see CIBC-TD Merger).

21st Century

As an alternative to the merger, and to maintain a competitive growth rate, the Bank of Montreal implemented several strategies. First, it augmented the bank’s international operations when it purchased another Midwestern American bank, Marshall & Ilsley (M&I) of Milwaukee, Wisconsin, for US$4.1 billion in 2010. This transaction added US$63.5 billion in deposits and 250 branches. Later, M&I was merged into the operations of BMO Harris Bank. Several other small American bank acquisitions were also concluded at the time. Today, US banking contributes 23 per cent to the Bank of Montreal’s total reported earnings (2018).

The Bank of Montreal also expanded its wealth management operations. To do this, it purchased and merged several domestic and international investment management firms. In 2001, they purchased Toronto’s Guardian Group of Funds Ltd., in 2011 Lloyd George Management of Hong Kong, and in 2014 the Foreign & Colonial Asset Management of the United Kingdom. These firms were all in addition to Montréal-based Jones Heward Investment Management, which the bank had acquired in 1994 with the purchase of Burns Fry. In 2018, the wealth management component of Bank of Montreal contributed approximately 17 per cent of its total reported earnings.

The Bank of Montreal has also added to other segments of its operations through acquisition. For example, it expanded into life insurance with the purchase of the troubled US-based AIG Life Insurance Company of Canada in 2009. That same year, the bank acquired the Canadian credit card franchise operations of Diners Club North America. In 2015, the bank purchased General Electric’s transportation finance unit, the largest financer to the commercial truck industry in North America, for US$13 billion.

The investment banking business of BMO Capital Markets has continued to grow in the United States. In 2016, the bank acquired merger and acquisition advisory firm Greene Holcomb Fisher of Minneapolis, Minnesota. In 2018, it acquired New York-based fixed income broker-dealer KGS-Alpha Capital Markets.

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom