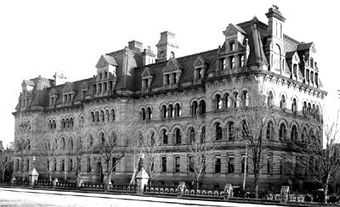

The Department of Finance Canada is the federal government's main engine of research, advice and analysis on national economic and financial affairs, including fiscal policy, debt management and taxation. It prepares the federal budget and tax and tariff laws, manages federal government borrowing on the financial markets and represents the country in international financial institutions. Managing the economy, especially through fiscal policy, remains the Ministry's most important function today. As of 2024, its staff numbers 942 persons, from 751 in 2014.

The Bank of Canada and the Auditor General report to Parliament through the minister of finance, who is also responsible for the management of the Consolidated Revenue Fund (CRF).

Background

The Department of Finance was formally created by statute in 1869, inheriting its title, structure and personnel from the small finance department of the pre-Confederation Province of Canada. Originally, its primary function was bookkeeping: administering the collecting and spending of public monies, and servicing the national debt. During World War I the federal government borrowed from and taxed individual Canadians directly for the first time (through Victory Loans and income taxes), which complicated but did not fundamentally alter the department's task. The Great Depression and World War II transformed the department into a hive of national economic managers. For the first time, university-trained economists such as Clifford Clark, W.A. Mackintosh and Robert Bryce occupied senior offices.

Massive expansion of the economy during the Second World War (Gross National Product doubled and total annual federal spending increased to 10 times that of the 1939 figure) led to an expansion of the influence of the department and, more generally, of the federal government as a whole. Its financial structure was changed permanently over the course of the Second World War with the introduction of Unemployment Insurance (now Employment Insurance) in 1941 and of Family Allowances (administered by the Canada Revenue Agency (CRA) under the name Canada child benefit (CCB)) in 1945. More significantly, in 1939 departmental officials developed a new approach to the federal budget. Instead of simply attempting to balance expenditures with revenues - the prewar practice - they began to use taxing powers and spending policies to influence economic development in general.

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom