The term Canadian dollar also denotes the exchange value of Canada’s currency in relation to other countries’ currencies. Under the flexible exchange rate system, the value of the Canadian dollar is continuously determined by trading in the foreign exchange market, where CAD is among the most traded currencies. CAD is considered a benchmark currency because it is held as a reserve currency by many central banks around the world. Trading is mostly carried out by chartered banks and large corporations in Toronto, Montréal, and New York. CAD is often referred to as a “commodity currency” because its value often correlates to commodity prices, especially the price of softwood lumber, minerals and crude oil.

History of the Canadian Dollar

Many currencies were exchanged in what is now Canada before the centralization of the Canadian dollar. In 1858, the decimal-based dollar replaced the Canadian pound, which was divided into shillings and pence. Decimalization aligned currency in the Province of Canada with the US dollar, and New Brunswick, Nova Scotia, Newfoundland, and British Columbia also adopted decimal-based currencies in the 1860s.

After Confederation, Ontario, Québec, New Brunswick, and Nova Scotia adopted the Canadian dollar, which was mainly backed by the gold standard. In 1871, the Uniform Currency Act and the Bank Act fully standardized dollars across Canada and established dollar denominations: dollars, cents, and mills (one tenth of a cent).

The Canadian dollar (CAD) has fluctuated between fixed and flexible exchange rates throughout its history. It was pegged to the US dollar (USD), meaning that CAD’s value rose and fell at the same rate as USD, between 1858 and 1938 and again between 1962 and 1970. Since then the Canadian dollar has fluctuated from as high as US$1.08 in 2007 to as low as US$0.62 in 2002.

Dollar Value and the Foreign Exchange Market

The Canadian dollar is traded on the foreign exchange market under a system known as the flexible (or floating) exchange rate, in which currency prices change at any given time based on their supply and demand in relation to the value of other currencies. The Canadian dollar is among the most traded currencies on the foreign exchange market, along with the United States dollar (USD), the euro (EUR), Japanese yen (JPY), Great British pound (GBP) and Swiss franc (CHF). The USD is the standard currency for such commodities as crude oil and precious metals. As the majority of Canada’s international trade is with the US — especially Canadian crude oil exports — the value of the Canadian dollar often correlates to the strength of the US economy and dollar.

From day to day, the value of the Canadian dollar is affected by news of important economic events, changes in expectations about Canada’s economic prospects, and government actions. Over longer periods, the dollar’s value is related to the cost of Canadian goods relative to comparable foreign goods. When Canadian prices rise (inflation) faster than foreign prices, the dollar’s value falls relative to foreign currencies. If Canadian prices rise more slowly than foreign prices, the dollar’s value rises.

The value of the dollar is important to Canadians for two reasons. First, because Canada is a trading nation, changes in the value of the Canadian dollar affect the prices of goods that Canadians sell abroad as well as the prices of goods that Canadians purchase from abroad. As the value of the Canadian dollar rises, Canadian exports become more expensive, reducing demand and causing domestic unemployment. The Canadian prices of imported goods are reduced, reducing the rate of inflation. When the value of the Canadian dollar falls, foreigners demand more Canadian exports.

The second reason why the value of the Canadian dollar is important to Canadians is that changes in the value of the Canadian dollar affect Canadians’ financial dealings (both as lenders and borrowers) with foreigners. A rise in the value of the Canadian dollar reduces the cost of paying foreign loans and the return on Canadians’ investments abroad (see Foreign Investment). A fall in the dollar’s value has the opposite effect.

Commodity Currency

The Canadian dollar is known as a commodity currency, meaning its value often correlates to commodity prices (see Commodity Trading). Natural resources such as crude oil, wood, and precious metals and minerals are an important part of the Canadian economy and account for a significant portion of Canada’s exports. As a result, the Canadian dollar often rises and falls with their prices.

Currency Intervention and Monetary Policy

The government affects the value of the Canadian dollar in two ways. The government can change the value of the Canadian dollar over short periods by buying or selling Canadian dollars in the market, a process known as foreign exchange intervention. A more long-lasting effect can be achieved by using monetary policy. In this case, the government modifies Canadian interest rates, changing the attractiveness of investing in Canada (see Foreign Investment). This, in turn, affects the demand for, and ultimately the value of, the Canadian dollar.

Money

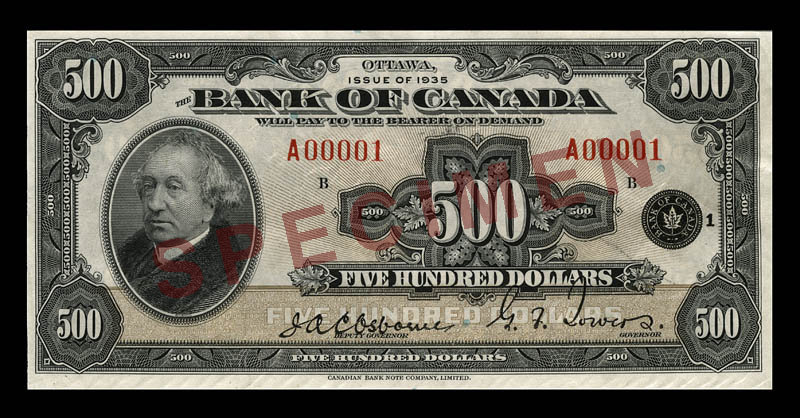

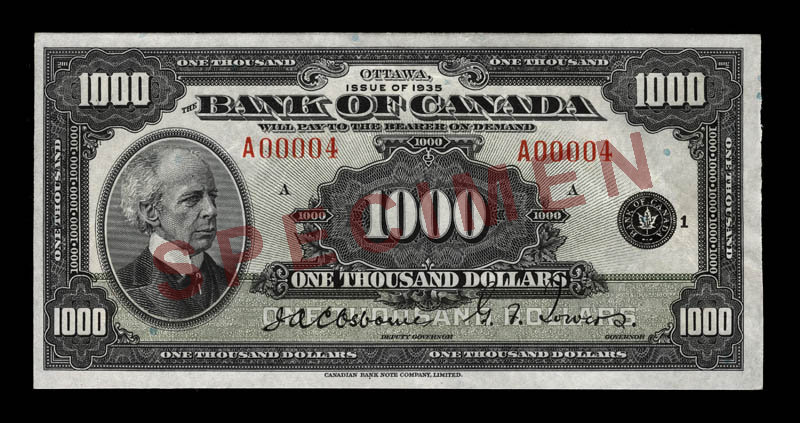

The Canadian dollar is the measure of value in which all prices in Canada are expressed and the medium of exchange for goods and services. It is divided into 100 cents (¢) and is available in material form as coins circulated by the Royal Canadian Mint and banknotes circulated by the Bank of Canada. Coins in circulation include the 5¢ (nickel), 10¢ (dime), 25¢ (quarter), 50¢ (half dollar) pieces, as well as the $1 (loonie) and $2 (toonie) coins. The mint stopped making the 1¢ coin (the penny) in 2013. The first loonies were minted in 1987, replacing the $1 banknote, followed by the toonie in 1996, which replaced the $2 banknote. Banknotes in circulation include the $5, $10, $20, $50, and $100 bills. (See also Money.)

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom